The Home of Rural New Zealand

Country TV is dedicated to delivering the best rural content to your screen. Many viewers tune in daily throughout New Zealand to enjoy quality programmes from home and abroad. We bring our subscribers a rich selection of the very best in agribusiness, rural news and current affairs, a daily 10-day long-range rural weather forecast, rural lifestyle and entertainment programmes, and the very best of local and international equestrian sports. Tune into channel 81 on the SKY TV platform, or watch Country TV Online and be informed and entertained by our diverse content. Country TV has something for every member of the family!

Country TV Online

Watch Country TV on your mobile, tablet or PC.

See the latest news and weather online.

Access our comprehensive Video on Demand library.

View more than 500 hours of exciting programmes.

Enjoy the live stream of the television channel.

Get a monthly or annual subscription.

30 Day Free Trial

Are you keen to have a peek into our Country TV Online platform?

You can sign up now to Country TV Online and get a 30 Day Free Trial* with unlimited access to the Live TV stream and our extensive Video on Demand library. Just enter the promo code FREE30 while subscribing and enjoy 30 days of high class rural and equestrian entertainment. You can cancel your Free Trial at any time.

*T&C’s Apply: Available for new signups only and cannot be used in conjunction with other promotional offers. A credit card is required for signup. At end of free trial the full subscription fee will apply and will be automatically charged to your credit card, unless subscription is cancelled before end of free trial period. Read full Online Terms of Use here.

Our Programme

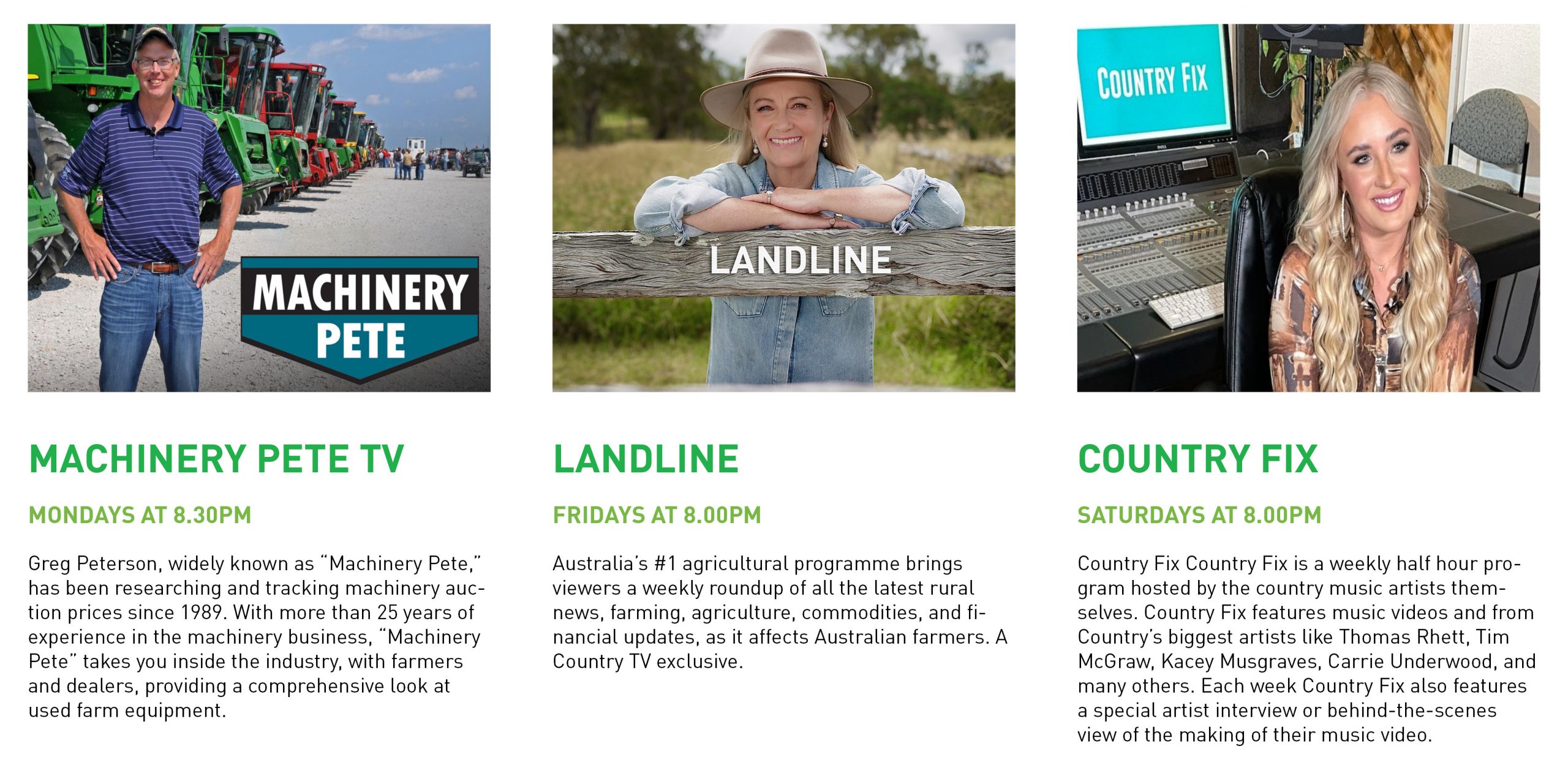

Broadcast on SKY channel 81, Country TV is New Zealand’s home of authentic rural television, dedicated to providing interesting and relevant information and entertainment to New Zealand farmers as well as the rural and equestrian communities. See below Country TV’s weekly TV guide. You can download the complete monthly TV guide here:

Interactive TV Guide

Download TV Guide

Country TV Online

Country TV Online

Country TV Online lets you watch all your favourite shows comfortably on your phone, tablet or computer, allowing you to watch whenever and wherever you want.

What’s the weather doing?

What’s the weather doing?

The latest weather updates

on Country TV.

What’s New in Equestrian Sports?

What’s New in Equestrian Sports?

Country TV’s Tuesday nights are focusing on equestrian sports. Tune in and enjoy the best equestrian action, homegrown in New Zealand.

TV Guide

Country TV is New Zealand’s home of authentic rural television, dedicated to providing relevant information and entertainment to New Zealand farmers as well as the rural and equestrian communities. With our handy TV Guide, you will never miss your favourite show on Country TV.